Varonis (VRNS) Q1 2022 Earnings: A Mixed Quarter, Unique Assets and Weakness Means a Buy

NicoElNino/iStock via Getty Images

After Varonis (NASDAQ:VRNS) F1Q results, we will buy stocks on weakness here. As expected, Varonis reported numbers that broadly matched estimates and provided guidance considered mixed. Depreciation of revenue from Russia impacts Varonis revenue and orientation. According to CFO Guy Melamed:

Historically, Russia has only represented about 1% of our business. As a result of sanctions imposed by the United States and other countries, the delisting of this activity in the first quarter had an impact of approximately $3 million on the ARR. For the full year, we assume a zero contribution from the region.

Therefore, the impact to our original revenue and ARR expectations will be in the range of $4-5 million.”

Varonis maintained full-year revenue and ARR guidance despite reduced contribution from Russia, citing strong demand trends. However, the stock is showing aftermarket weakness, providing investors with a decent entry point for a unique asset in security software.

Hackers and malicious insiders are constantly looking for valuable data such as customers, patients, employees, financial records, strategic product plans, and other sensitive information. Most of the time, this data is stored in files and emails and various databases and other applications such as Salesforce, HubSpot, etc. Varonis is the most comprehensive data-centric software reader today. Varonis’ solutions focus on the security of the data itself rather than the security of networks, servers or applications, which makes the asset quite unique. As the volume of data continues to grow unchecked, securing data becomes very complex and time-consuming. We believe Varonis has one of the best solutions on the market, and expect the company’s stock to do well as the company continues to execute on its go-to-market and product roadmaps. .

Another good quarter

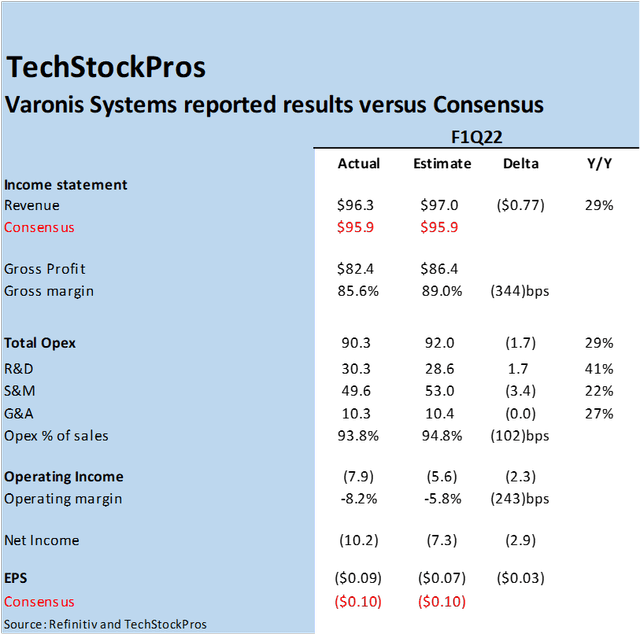

Varonis reported a mixed quarter, beating on revenue and EPS and leading both for F2Q and for the full year. Varonis reported revenue of $96.3 million, slightly above the consensus estimate of $95.9 million and at the top of its earlier guidance of $94.5-96.5 million. EPS was a loss of nine cents, even better than the consensus loss of ten cents. The EPS outperformance was driven by higher-than-expected revenue and lower-than-expected operating expenses. Total revenue increased approximately 29% year-over-year, subscription revenue increased approximately 54% year-over-year, and the company generated $24.5 million in cash from operations. ARR was $404.5 million and increased 32% year-over-year.

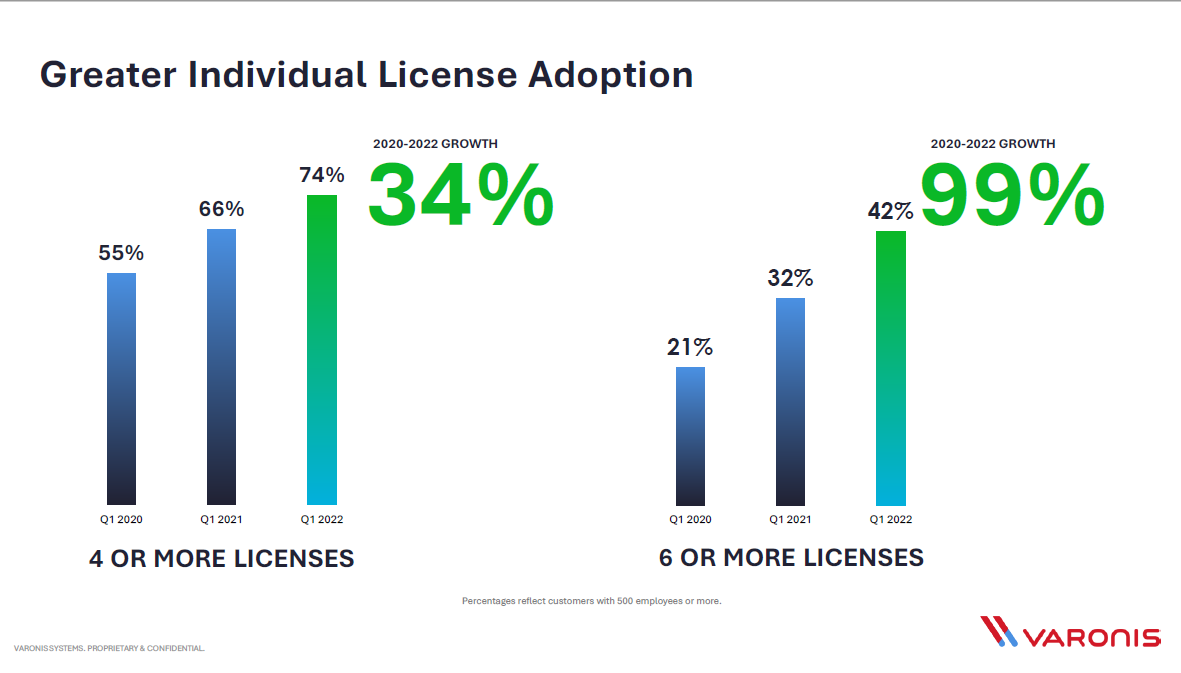

North America revenue increased 31% to $69.1 million and accounted for 72% of total revenue. EMEA revenue increased 20% in the quarter. The company noted that 74% of its customers have four or more licenses and 442% of the install base have deployed six or more licenses. The following chart illustrates the growth in licensing adoption.

Varonis

The following chart illustrates Varonis’ performance against our estimates.

TechStockPros

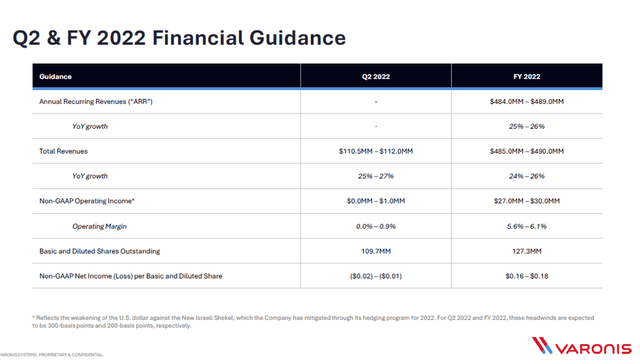

Conservative advice is the norm

Varonis is not a flashy company known for issuing aggressive guidelines. Varonis is downright conservative and known for his cautious advice. We believe that F2Q forecasts are no exception. Varonis guided second-quarter revenue in a range of $110.5 million to $112.0 million, versus an earlier consensus estimate of $111.5 million. EPS is expected to be between minus two cents and minus one cent, versus an earlier consensus of minus one cent. Depreciation of revenue contribution from Russia and foreign exchange impact guidance for Q2 and full year. The company reaffirms its full-year guidance for ARR and revenue. CFO Guy Melamed noted that:

While sanction depreciation is the current reality, we are seeing a strong demand environment. Accordingly, we are reaffirming our original full year guidance for both ARR and revenue.”

The following chart illustrates Varonis’ advice.

Varonis

Potential Take-Away Candidate

We continue to believe that Varonis is a compelling acquisition candidate for various companies. Varonis products have synergies with security and infrastructure companies. Varonis is probably the only company that comprehensively addresses the issue of data security. A single codebase drives all Varonis products. The company’s revenue and business model are attractive, given that it has already moved from a perpetual sale model to a subscription model. The company has approximately 8,000 customers worldwide and has significant headroom to enter the enterprise and mid-market segments.

The historical range of take-home multiples for software names is 4-8x based on EV/Next Twelve Month (NTM) sales, but given the subscription model, the multiple could be much higher and l 10 to 20x order. SailPoint (SAIL) was recently taken private at a multiple of 11 by Thoma Bravo. If we give Varonis the exact multiple to take away, that translates to a stock price of $65.

What to do with inventory

Over the past six months, many high-growth tech stocks with virtually no earnings have continued to suffer at the hands of investors. Varonis data-centric security is a unique property in our universe of coverage. Despite being best-in-class software, Varonis has also suffered at the hands of investors.

Following the mixed results of Varonis, the title indicates a weakness of the secondary market. We urge investors to buy weakness. Varonis is the only data-centric security in our coverage universe. Varonis products effectively secure data dispersed across the enterprise. Additionally, data is also scattered across various SaaS applications such as Jira, GitHub, Salesforce (CRM) and Dropbox (DBX), presenting businesses with high risk. As data proliferation continued and worsened with the onset of the COVID pandemic, the attack surface continued to expand. When the attack surface expands, it is difficult to secure it. We believe Varonis is one of the most effective solutions in the industry. Therefore, we expect it to increase north by 20% over the next few years.

The company is conservative when issuing guidelines. Therefore, we expect the quarterly beat and rise to continue. We are very confident in Varonis’ growth prospects and its position in the data security landscape. With long-term growth prospects, a reasonable valuation and an excellent risk-reward profile, we urge new investors to buy stocks here. We own the stock and would buy a few more shares on weakness to build a great position over time.